By

By now, we all know the myth of selling a film to a distributor at a film festival for a bounteous cash advance and a robust release campaign is just that: a myth. Like lots of myths, however, there may be enough rare instances of fabled sales beneath the big façade that keep the dream alive. But overall, the data for festival acquisitions reflects a very sobering landscape, with all but a sliver of documentary films benefiting from a largely closed and highly competitive ecosystem that is likely only to get worse.

Over 2022, Distribution Advocates contacted all the documentary feature film teams with projects premiering at the Sundance, SXSW, and Tribeca film festivals to get a fuller picture of the relationship between documentaries and the film festival marketplace as a point of sales. Over 100 filmmakers responded to the questionnaire, which was designed in collaboration with the Center for Media and Social Impact, sent out approximately one month after their festival premieres, and featured questions around filmmaker diversity, funding, and acquisitions. The data was initially presented as part of an expanded panel discussion on festival distribution at IDA’s Getting Real conference in September 2022, which is the main source of information for this article.

During the discussion, Brigid O'Shea, founder of the Documentary Association of Europe, summed up one of the key challenges right now for documentary filmmakers. “The trade press tells us there are more places than ever before to show our films, but I have a feeling it is not true,” she said. “The distribution possibilities for documentaries are becoming more and more limited.”

Indeed, the abundance of new streaming platforms gobbling up as much as diverse content as possible has given way to corporate consolidation and retrenchment, with companies such as Netflix, Amazon, and CNN now turning away from the acquisitions of independently made documentaries and focusing more on internally produced “mainstream” nonfiction content. At the same time, the theatrical market for documentaries has bottomed out over the last year, with very few nonfiction films earning even modest box-office dollars, which could potentially put a chill on theatrical sales in the coming year.

In such a gloomy economic environment, independent doc filmmakers believe that festivals remain one of the only places where indie docs can access the industry and raise their profiles.

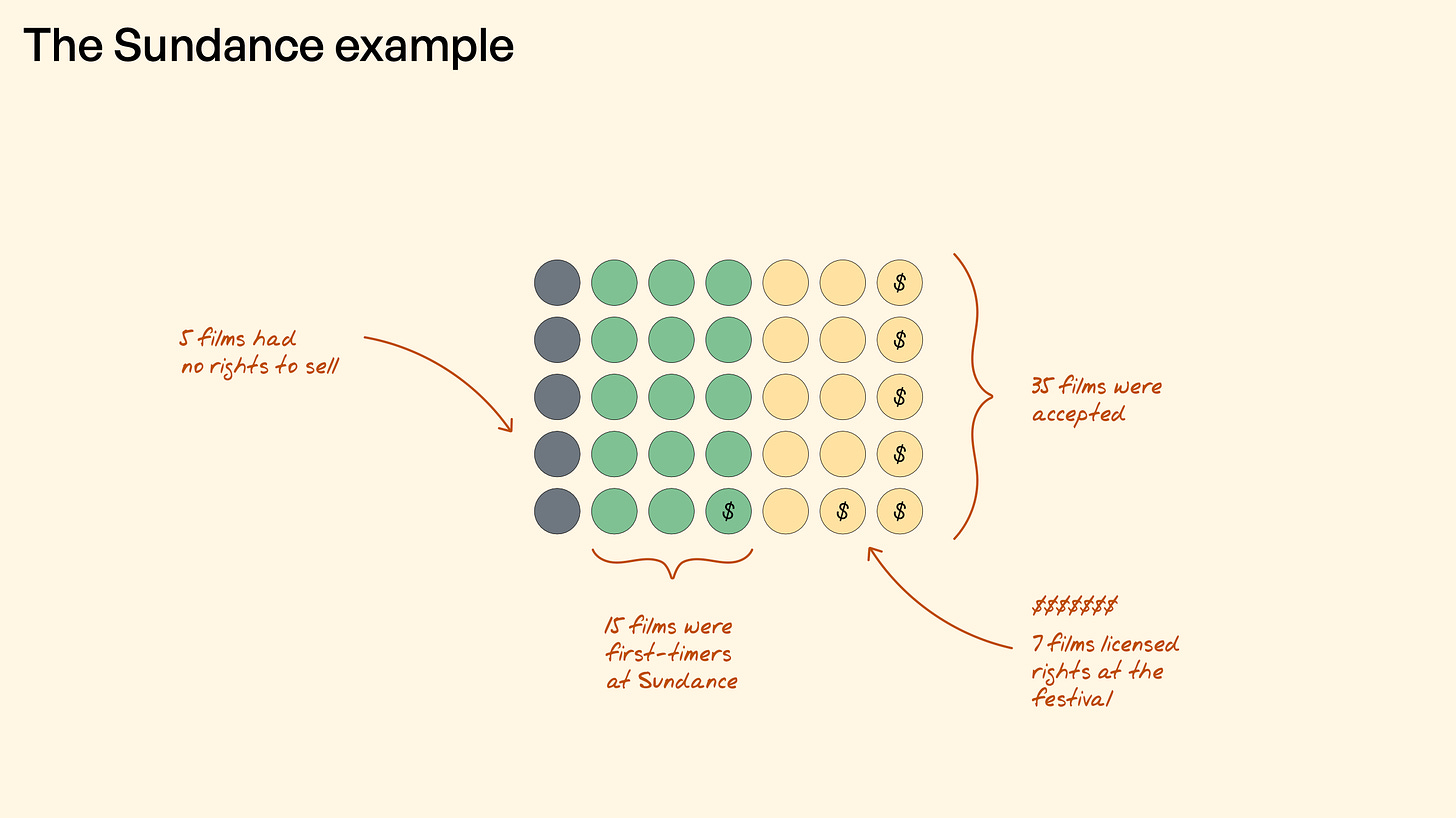

But the barriers to entry are many, the first of which is simply getting admitted into an A-list festival. Acceptance rates last year, for example, ranged from approximately only 2% (for Sundance) to 4.2% (for SXSW), according to information provided by the festivals. Most accepted films (57%) had a producer or director that previously showed a film at the same festival, suggesting that newbies are in the minority. Demographic data also indicates that female film teams have made gains in recent years (nearly 56% of documentary makers participating at the festivals were female), but diversity remains painfully lacking, with 8.7% of those polled identifying as Hispanic filmmakers, 5.8% as Black or African Americans, and nearly 70% as White or European.

“I find that troublesome, especially with Sundance,” said Su Kim, the Emmy-winning producer of 2022 Sundance entry Free Chol Soo Lee and Oscar shortlisted doc Hidden Letters, “because that was the festival for the outsiders, and it started for a place of highlighting voices, and I think that is changing now.”

“The data collected here reveals the tension between these festivals’ stated goals to discover new voices, while also keeping their alumni very close,” added Lucy Mukerjee, co-founder of the Programmers Of Colour Collective and currently the Programming Director of Tasveer. “The demographics of the directors didn't surprise,” she added. “I know there is a lack of financing going towards BIPOC and trans and nonbinary filmmakers, not just in documentary, but across the board.”

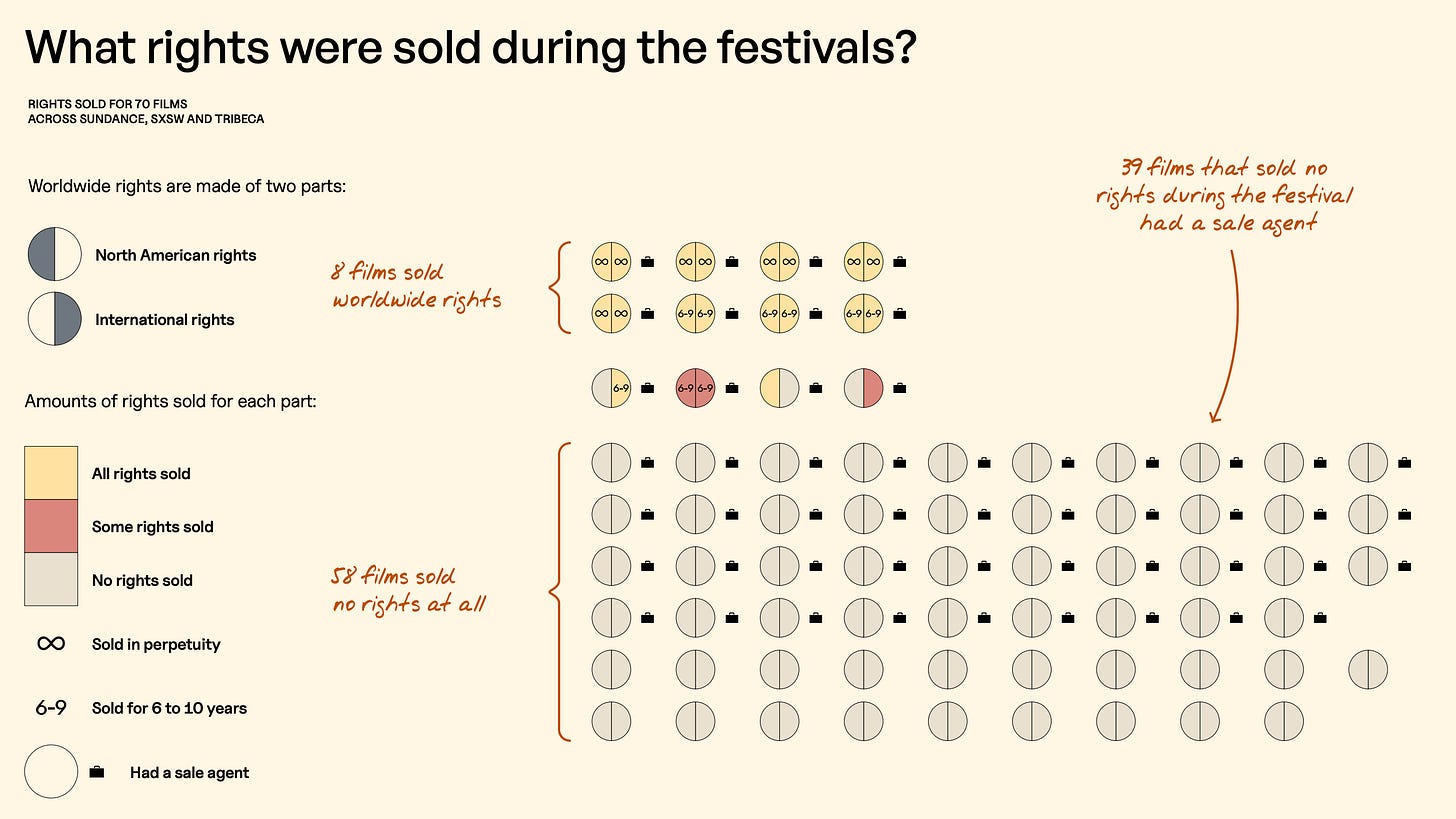

Once a documentary overcomes the enormous hurdles of financing, production, and festival acceptance, a distribution deal is by no means assured, and may take months to close. Of 70 films that played at Sundance, SXSW, and Tribeca, 58 films sold no rights at all within a month of the festivals, which translates to about 83% of those polled. Notably, 39 of those projects had a sales agent. Only 11% of respondents (a total of 8) reported selling worldwide rights, five of which were in perpetuity (the remaining three for licensing of 6-9 years). Four other projects reported selling partial rights; of those, one rare project sold international but not domestic rights.

Industry insiders point out that finding a distributor may take well more than a month, with a quick sale more the exception than the rule. “It is not necessarily a success or failure if a film doesn't sell in its first month [after premiering],” said Jason Ishikawa, a senior sales executive at Cinetic Media. For example, Sundance winner and Oscar contender All That Breathes was acquired by HBO Documentary Films in May, four months after its premiere.

For Ishikawa, it’s wrong to think that sales agents go into festivals in “auction mode” for every film. Such a strategy “can be really high-risk for certain films and expectations have to be there in order to pull it off successfully,” he explained. Buyer and industry attendance may also be shrinking at festivals. “They are going for a shorter amount of time; they are bringing less people than they normally do,” Ishikawa said. “And when their time is compressed in that way, it is harder to engage people.”

Ishikawa maintains the marketplace is year-round. “You're seeing a lot of films entering a marketplace off of trailers or sizzle reels and that changes the types of films that become available to a film festival that wants to be an acquisitions marketplace,” he said.

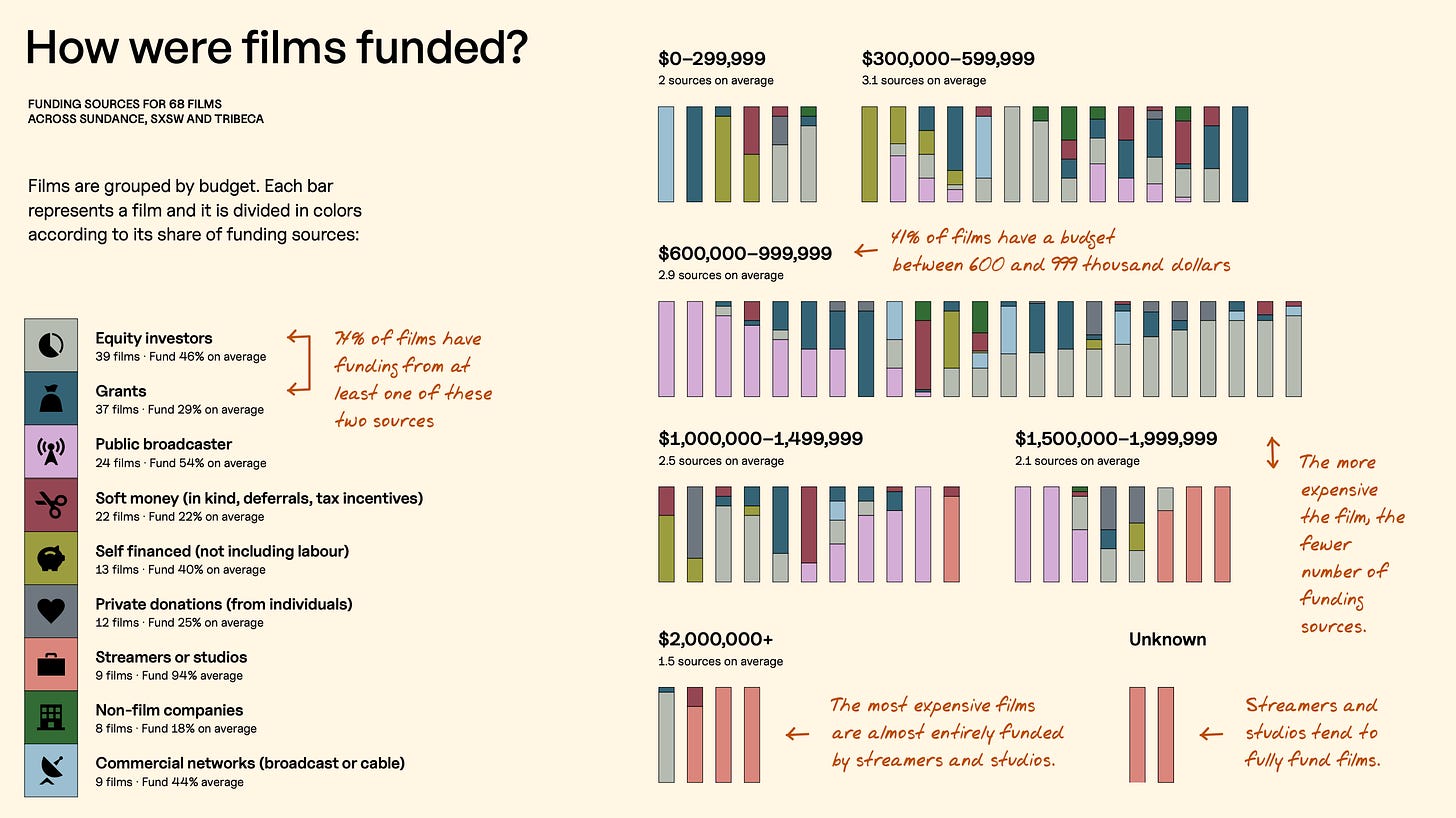

According to data collected by Distribution Advocates, most documentaries at festivals with larger budgets (over $1.5 million), for example, are entirely funded by streamers and studios, which takes them out of the festival acquisition equation. Of 73 films selected across Sundance, SXSW, and Tribeca, 15 films were in such a position, with rights already taken. A clear majority, 47 titles, premiered at festivals while retaining all their rights after funding and production, which also aligns with the financing information gleaned by the survey: the top two ways documentaries at these festivals were funded is through equity investors and grants, both of which give filmmakers money to make their films, of course, but no certain pathway to recoupment or distribution.

Such festival launches are highly intensive and costly endeavors—with the hiring of sales agents, publicists, and travel expenses—so filmmakers would benefit from knowing the cost-to-benefit ratio of such showcases. All filmmakers want an audience and all filmmakers want industry attention, but at what price?

As Mukerjee noted, “If these top-tier festivals exist as a marketplace to connect filmmakers to the industry, how could this be approached differently to get a better result? Is there a better way to do this? And should these festivals see it as a responsibility that they need to serve?” Furthermore, Mukerjee suggested the number and type of acquisitions should be readily disseminated, since the festivals already tracked that data for their own evaluation. “If that information could be made public at the end of each year,” she added, “filmmakers can use that knowledge and insight to decide whether they submit and where they spend their submission fees.”

Amy Hobby, co-founder of Distribution Advocates, also brought up another question—and essential bit of information—that filmmakers should know: “What percentage of a film’s budget is recouped when making licensing deals out of a festival?” According to Hobby, the data pool was too small to make any definitive claims, but they gathered there was a large divide between films that recouped 100% and those that recouped less than 25% of their budget. “There was nothing in the middle,” she said. “It seemed the percentage of budgets covered from sales advances were either robust or fairly small.”

The Getting Real ‘22 panel also painted a disconcerting portrait of the international market for documentaries. While the lucky 2% that lock a premiere spot at a festival, especially Sundance, will likely be able to leverage further festival berths abroad, there were serious concerns about the health of the foreign market for docs. O’Shea suggested that more data compiled by Distribution Advocates could help filmmakers better control the destiny of their films, but that it was important to be “honest with ourselves,” she said. “At least inside of Europe the theatrical market at the moment has totally bottomed out, cinemas are empty, and it’s a matter of time before there is a reckoning about that. The opportunities to work with public broadcasting systems that we’re used to working with have shrunk, shrunk, shrunk.”

Jason Ishikawa agreed. “In terms of the global marketplace, it's really tricky,” he said. “For American films, we're not seeing as much opportunity for nonfiction as there has been in the past” in terms of the broadcast sale marketplace.” The result, according to Ishikawa, is forcing filmmakers to make a pact with global streamers seeking worldwide rights, “because [the streamers] can value a film in a way that is a little more compelling than going territory by territory,” he continued. “That is not the case for every film, of course, but by and large, especially films coming out of American film festivals by American filmmakers, there are no dedicated slots.”

As filmmakers wrestle with the data and a way forward in the currently muddled marketplace, O’Shea made sure to remind filmmakers that there is no cookie-cutter path for a film’s success, “because for every film there is a different strategy and there is a different sales possibility,” she said.

However, the commonly held belief that a festival launch at Sundance, Tribeca, SXSW (or Hot Docs, Telluride or Toronto, for that matter) is the easiest pathway for filmmakers looking to land a sale and recoup requires further investigation and research — something that the industry itself appears to resist.

Distribution Advocates’ Amy Hobby says, in their efforts to collect data, “we were surprised at the reluctance of many film producers to share data, even anonymously via a survey. Some producers expressed fear of retribution from sales agents or distributors, while others dismissed the importance that could come from a better understanding of the landscape.”

In response to this reluctance, Hobby shares, “Distribution Advocates is excited to pivot our approach this year to share experiences through a more in depth narrative approach which might shed light on the obstacles that independent filmmakers are facing in the distribution space today."

To read the full report, ““US Film Festivals as a Point of Sale for Documentaries,” click here.

I find this information very important. Having run an International Filmmakers Organization for 20 years and a Sales & Marketing Company that sold films around the world for 11, I see the market for low budget independent films even more difficult today than back then.